UK Basel 3.1: Credit risk standardised approach – exposures to institutions

On 30 November 2022, the Prudential Regulation Authority (PRA) published a Consultation Paper 16/22 (CP16/22) proposing the implementation of Basel 3.1 standards. The framework was originally proposed to be implemented on January 1, 2025. However, according to the news release dated September 27, 2023, the revised implementation date is July 1, 2025. A brief summary of the changes proposed to ‘exposures to institutions’ under the credit risk standardised approach is provided below.

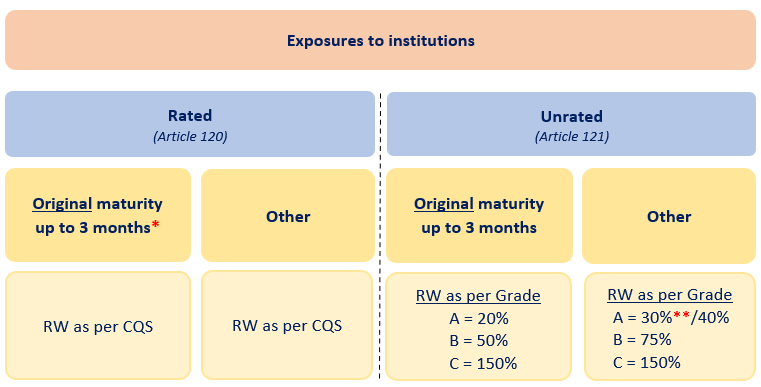

Key changes to exposures to institutions (Article 119), under the standardised approach, include:

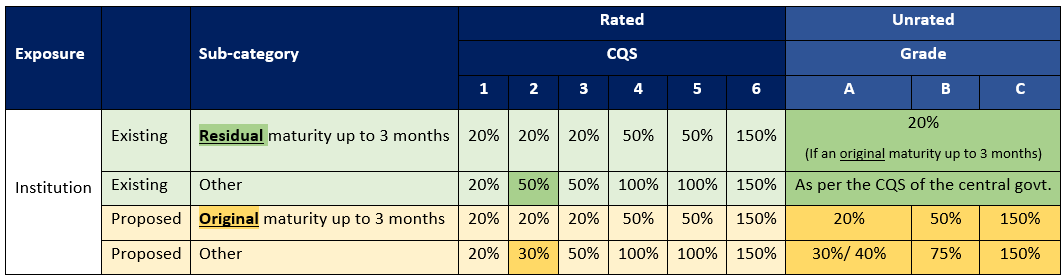

A reduced risk weight of 30% (currently 50%) has been proposed for Credit Quality Step (CQS) 2 rated institutions.

Base maturity changed from ‘residual’ to ‘original’ maturity.

Due diligence^ requirements are added to ensure external rating prudently reflects the creditworthiness of institutions, if not, at least one step higher risk weight is to be applied.

A new more risk-sensitive approach^^ has been introduced to assign risk weight for unrated exposures to institutions.

The following two conditions are removed:

exposures to institutions of a residual maturity of three months or less that are denominated and funded in the national currency of the borrower shall be assigned a risk weight that is one category less favourable than the preferential risk weight assigned to exposures to the central government; and

no exposures with a residual maturity of three months or less that are denominated and funded in the national currency of the borrower shall be assigned a risk weight of less than 20%.

A summary of the proposed classifications and applicable risk weights is given below:

* Exposures to rated institutions where the original maturity of the exposure was six months or less and the exposure arose from the movement of goods across national borders shall be assigned a risk weight in accordance with the credit quality step for ‘original maturity up to 3 months’.

** A risk weight of 30% may be assigned if a Common Equity Tier 1 Ratio >= 14%, and a Leverage Ratio >= 5%.

Existing and proposed Risk Weights

^ As explained in the ‘exposures to corporates’ section.

^^ Exposures to unrated institutions shall be classified into Grade A, Grade B or Grade C as given below:

Grade A

Adequate capacity to meet financial commitments irrespective of the economic cycles and business conditions, and

meet or exceed the minimum financial regulatory requirements (Pillar 1 & Pillar 2A) and buffers (combined buffer & the counter-cyclical leverage ratio buffer, if applicable)

Grade B

Repayment capacity is dependent on stable or favourable economic or business conditions, and

meet or exceed the minimum financial regulatory requirements (excluding buffers)

Grade C

Material default risks observed, or

does not meet the criteria for being classified as Grade B with respect to minimum regulatory requirements, or

the external auditor has issued an adverse audit opinion or has expressed substantial doubt about the ability to continue as a going concern.

Note: Risk weights assigned to unrated institutions cannot be less than the risk weight applicable to the central government where the unrated institution is incorporated, if:

the exposure is not in the local currency of the jurisdiction of the debtor institution (e.g., a USD placement with a bank incorporated in China) ; and

the exposure is not a self-liquidating, trade-related contingent item arising from the movement of goods with an original maturity of less than one year