Funds Transfer Pricing

The Funds Transfer Pricing (FTP) is a methodology used by banks to aid in product pricing, liquidity and funding management, balance sheet management and profitability management.

For most banks, the FTP plays a crucial part of the process of setting both retail and commercial interest rates. The mechanism is designed to not only account for the cost of funds, but also other aspects like operating expenses and key risks (e.g. liquidity, interest rate, currency risk) that are associated with the banks’ lending and deposit taking activities.

As for small- and medium-sized banks, an FTP mechanism is highly beneficial for decision making when it comes to profit allocation, choice of business activities and overall appetite for risk. This is done by facilitating the banks’ senior management to identify the imbalance between rates offered and the calculated FTP rate, thereby enabling suitable revisions based on risk profile, tenor and marketing plans. This will enable banks’ to achieve the expected rate of return not only in the near term but also in the longer run.

The sections below contain a brief overview of the FTP and how Katalysys can help small- and medium-sized banks implement such a process.

Treasury Function

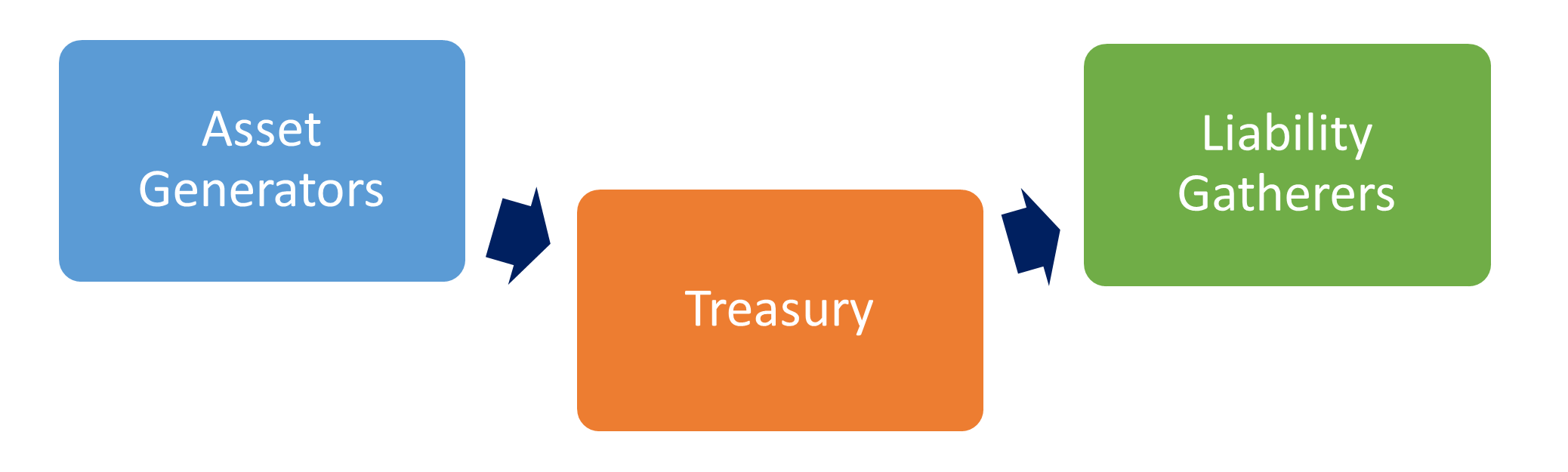

A bank’s Treasury function acts as a central hub (a bank within the bank) for all the different business departments within the bank that extends loans and raised deposits. In simplistic terms, the FTP process could be considered as the treasury centre, extending internal loans to departments to fund customer lending, or accepting an internal loan from the departments raising customer deposits.

Each of the main business units in a bank are classified into one of two categories:

Liability Gatherers – Units responsible for obtaining funds, i.e., Deposits.

Asset Generators – Units responsible for utilising funds to create assets, i.e., Loans.

Treasury will act as a bank within the bank (or broker), and be responsible for managing the cash generated (or required). Any surplus cash could then be deployed by the Treasury in Nostros, money markets, or to buy securities. Similarly any shortfall, expected to be short-term, will be met by raising customer deposits or borrowing in the money markets.

Where required, Treasury may also undertake necessary foreign exchange derivative contracts in order to hedge or support the business. As for most small- and medium-sized banks, the bank’s trading book may also qualify for the regulatory definition under ‘derogation of small trading book’. As part of this derogation, the capital requirement is evaluated as if it is an exposure to the banking book. Hence, the same approach can be adopted for transfer pricing of small trading book and treated as if it is an exposure to the banking book.

As a result of the central role that Treasury plays within the bank, they will build an internal pricing curve that acts as a reference rate at which the bank can borrow or lend money in the open market. This curve would form the basis on which Liability Gatherers will be compensated for funds generated, and Asset Generators will be charged for funds used.

FTP Approaches

There are a number of different FTP methods, and these can broadly be classified in to the following:

Cost of funds method - pricing of funds is based on weighted average cost of funds.

Net funding method – each business unit raise and deploys funds on their own, and approach the central Treasury function only if they have surplus and/or deficit funds. Treasury charges/compensates the business units a flat rate for the funds.

Pooled funding method – business units are separated based on deposit gatherers or asset generators. Different transfer prices are used for borrowing and lending.

Matched maturity method – funds are priced based on market rates, considering the maturity tenor. The pricing will be adjusted after considering market rates, liquidity buffer costs, capital charges, operational and other costs

Banks may adopt a number of different approaches depending on their size, business lines and overall operational structure. However for most small- and medium-sized banks we believe that the ‘matched maturity method’ is the most appropriate as it considers all aspects of pricing and underlying costs.

Loans and Deposits Pricing

The interest rate that Treasury charges each department for extending new loans, or remunerates it for raising new deposits, is called a ‘Transfer Price’ or ‘FTP Final Reference Rate’. Typically, a new loan will be priced at a spread above the Transfer Price, and new deposits are priced at a spread below the Transfer Price. The FTP Final Reference Rate has to be established for each material currency and for the different maturity tenors/time-bands.

The spread above and below the Transfer Price reflects a number of internal and external factors; mainly including market rates, tenor premium, capital charges, expected losses, cost of High Quality Liquid Asset (HQLA) buffer, operational costs and marketing incentives/discounts.

A simplified and stylised version of the loan and deposit Transfer Price (or FTP Final Reference Rate) for a specific time-band/maturity tenor (say 1 year loan and 1 year deposit) and currency (say GBP) is shown in the figure below:

As shown above, any new loan made at more than 2.96% will ensure that a positive rate of return is generated after considering internal and external cost factors. Similarly, for deposits, any deposit that is raised below 1.65% (after deducting any relevant charges e.g. HQLA and other charges) will have a favourable impact on the overall rate of return.

It should be noted that for any given currency, the FTP process involves assigning a loan/deposit to a curve (‘FTP Final Reference Rate’) that reflects its Transfer Price at different maturities.

FTP Composition

As part of the FTP process and ‘matched maturity method’, a number of internal and external factors will be assessed to help derive at the ‘FTP Final Reference Rate’ (as shown in Figure 2).

The figure below provides a summarised version of these components categorised under Assets Generators and Liability Gatherers:

How can Katalysys help you?

Katalysys has helped a number of small- and medium-sized banks in developing FTP framework and processes, using Katalysys’s k-ALM® FTP tool-kit. This approach provides a bespoke solution that is tailored to the bank’s specific business model and internal operations.

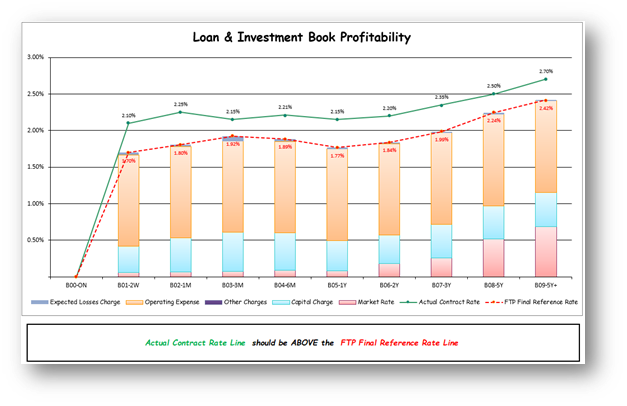

The k-ALM FTP took-kit offers a comprehensive analysis of the bank’s FTP by first building a fit-for-purpose framework and approach, and then implementing a cloud based solution to deploy various customisable reports. These reports provide detailed breakdown by product lines, departments and currency, which enables the bank to take informed decisions on balance sheet and profitability management and product pricing. Examples of such reports from the k-ALM® tool-kit are shown below:

Once implemented, the k-ALM FTP process can be run on a regular basis (or when as required) using data from the banks’ own core banking system or regulatory reporting system.

The k-ALM FTP developed Katalysys is part of the overall k-ALM tool-kit, which has additional modules that can be used for stress testing, “what-if” modelling and prudential risk management (capital, liquidity, interest rate risk management).

Please feel free to contact us for a demo of the k-ALM tool-kit.