Non-maturity Deposits and Interest Rate Risk in the Banking Book

Background

Effective 1 January 2022, the Prudential Regulation Authority (PRA) implemented new requirements and expectations for banks regarding Interest Rate Risk in the Banking Book (IRRBB) (see our earlier Article) via the Internal Capital Adequacy Assessment Part of the PRA Rulebook (ICAA Rules) and ‘The Internal Capital Adequacy Assessment Process (ICAAP) and the Supervisory Review and Evaluation Process (SREP)’ (SS31/15) (collectively UK IRRBB Rules).

One important aspect within the UK IRRBB Rules is to incorporate into measurement processes – as appropriate – behavioural assumptions.[1] For some institutions, including many small- and medium-sized banks, a significant matter in this area is the treatment of non-maturity deposits (NMD).

NMD are liabilities whereby the depositor is free to withdraw their deposit at any time since there is no defined contractual maturity date.[2] Similarly, banks are typically able to adjust the interest rate attached to NMD on a unilateral basis. In contrast to NMD, fixed-term deposits generally have known future repricing dates (e.g., the maturity date); and floating rate liabilities may contain predefined reset dates (e.g., overnight, every 3-months) linked to some underlying benchmark.

Despite the contractually short-term nature (using a repricing basis) of NMD, certain NMD or portions thereof may behave like longer-term, interest rate-insensitive positions. The inherent characteristics of NMD create complexities from the perspective of measuring, and in turn managing, IRRBB, meaning that a more involved approach is necessary.

[1] SS31/15, 2.9B(v)

[2] Basel Committee on Banking Supervision: Consultative Document - Interest rate risk in the banking book, Part II, 2.5

Regulatory Guidance

Regardless of whether a bank has elected to adopt the PRA’s Standardised Framework (SF), we recommend that behavioural modelling assumptions are incorporated into a bank’s IRRBB framework, including its measurement practices.

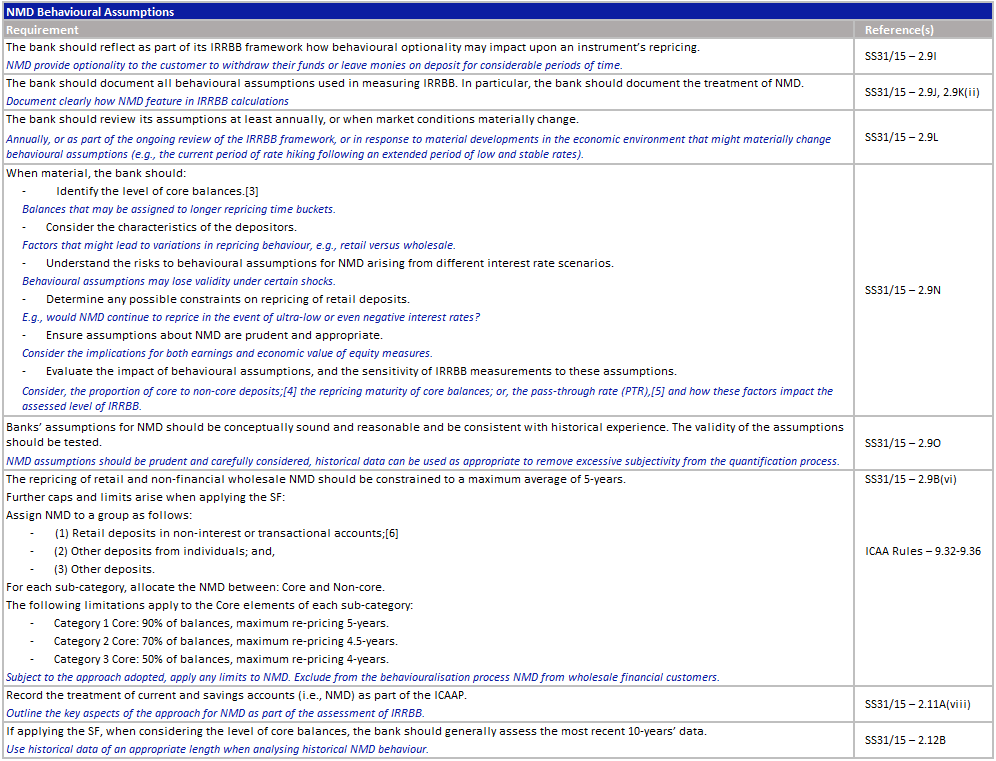

The key requirements relating to the behavioural assumptions for NMD are set out below:

[3] Core means deposits that are found to remain undrawn with a high degree of likelihood using data history of an appropriate length, and unlikely to re-price even under significant changes in the interest rate environment.

[4] Non-core means any deposit that is not a core deposit.

[5] Pass-through is the proportion of change in underlying market rates (e.g., Bank Rate) that will be passed on to customers. The PTR is the rate at which such changes must be passed on to customers to maintain the current level of deposits.

[6] Deposits from small businesses that the bank manages as retail exposures may be treated as retail deposits provided the customers’ total aggregated liabilities are less than £877,000.

Approaches for Determining NMD Assumptions

Two key points arise from the requirements set out in the UK IRRBB Rules. The first relates to classifying NMD as either core or non-core; and the second concerns the allocation of core NMD across repricing time buckets.

In on our experience, there are three typical approaches to defining NMD assumptions for the purpose of IRRBB measurement. Each methodology has its own merits and drawbacks, and some are likely to be more relevant to small- and medium-sized banks than others.

Note that time slotting of core NMD can be a component of the modelling approach itself, or it may be the subject of a second stage of assumption, e.g., by adopting a uniform method or using a discretionary slotting approach.

Key Actions for Small- and Medium-sized Banks

Some of the key actions small- and medium-sized banks should consider in respect of NMD are listed below. All apply at the level of material currency since significant divergence may arise based on this factor.

1) Assess the significance of NMD.

2) Analyse the types and characteristics of NMD to understand the implications for behaviour and IRRBB.

3) Select a proportionate approach to defining NMD assumptions and conduct the analysis.

4) Quantify the impact of NMD assumptions, and the associated sensitivity of IRRBB measurements.

5) Review the outputs and conduct appropriate governance processes.

6) Fully document the final assumptions, interpretations, and judgements in respect of NMD.

7) Embed the assumptions in the IRRBB measurement process.

8) Include NMD as part of the evaluation of IRRBB in the ICAAP.

9) Review the assumptions on an ongoing basis and update them as required.

How We Can Help

The implications for IRRBB arising from NMD can be complex, and the approach adopted may have a material impact on the assessment of a bank’s interest rate risk positions and associated risk management practices; it is therefore critical that banks fully understand their NMD and the associated risks and regulatory guidelines.

At Katalysys, we understand the challenges relating to NMD, both in terms of regulatory rules and industry best practice, as well as behavioural modelling and measurement. We also offer a cloud-based IRRBB measurement and reporting solution – k-ALM® IRRBB.

Our team has supported a range of clients in this area, from those seeking first authorisation to well-established institutions. Whether you need:

support understanding and interpreting rules relating to NMD;

assistance in modelling behavioural repricing assumptions;

guidance on incorporating the treatment of NMD into the risk framework or ICAAP; or,

an independent review of your existing approach for NMD,

We have the knowledge and technical skills to help.

For more information, please contact:

Josh Nowak

Managing Director, Risk & Regulatory Consulting

T: +44 (0)7587 720988