The PRA’s Proposed Approach to Policy (DP4/22)

1. Background

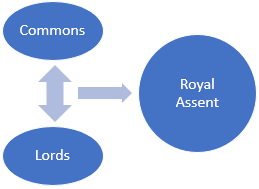

In July 2022, the House of Commons gave first reading to a new piece of legislation called the Financial Services and Markets Bill 2022 (the “Bill”). The Bill has progressed through the House of Commons to Committee Stage, where it will be examined line-by-line and may be amended by MPs before later being sent to the House of Lords for its consideration.

One aim of the Bill is to repeal most retained European Union (“EU”) law relating to financial services and to allow the Prudential Regulation Authority (“PRA”) to replace those repealed laws with new rules (“PRA Rules”).

The PRA recently published Discussion Paper 4/22 (the “DP”), which sets out its intended approach to policy in light of the provisions of the Bill.

2. The Bill

The Bill is moving through the various legislative stages of review but is not expected to receive royal assent until 2023.

In some instances, activity to replace retained EU law has already been observed; for example, the Financial Services Act 2021 gave permission to HM Treasury to revoke certain aspects of Regulation (EU) 575/2013 (CRR) (as well as associated rules), and HM Treasury indeed revoked Regulation (EU) 2015/61 (known as the Delegated Act, relating to the Liquidity Coverage Ratio). This was replaced with PRA Rules, as set out in the Liquidity Coverage Ratio (CRR) Part of the PRA Rulebook.

This process is expected to become far-reaching through the introduction of the Bill with most retained EU law relating to financial services being repealed. This will grant the PRA new responsibilities in several areas and, according to the regulator, allow it to become more responsive to emerging risks and the wider global regulatory environment.

One such example is the PRA’s introduction of the proposed Strong and Simple initiative announced via CP5/22, which is expected to be described in more detail later this year, or early next. This proposal allows the PRA to bring into force a simpler yet robust set of prudential rules for certain firms.

3. The PRA’s Objectives

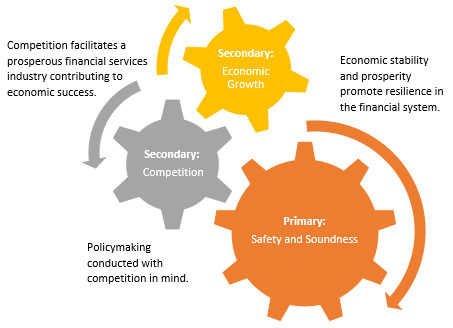

The PRA has historically been given two objectives, which were established via the Financial Services and Markets Act 2000: a primary objective of promoting the safety and soundness of the financial system; and, a secondary objective of facilitating effective competition between firms.

The Bill introduces an additional secondary objective for the PRA to take into account in its policymaking activities: facilitating the international competitiveness of the UK economy and the financial services sector, and its growth, with due regard to international standards and regulations. The PRA sees this new objective as complimentary to its existing purposes.

The PRA set out its approach to its new objective in the DP, stating that it intends to centre its attention on facilitating economic activity in the medium- to long-term, and steer clear of activities that might create short-term economic booms at the cost of long-term stability and economic resilience.

A further implication of the Bill is to introduce an expectation on the PRA to bear regard to the 2050 Net Zero target established by the Climate Change Act 2008, which supersedes the current regulatory target of supporting “sustainable growth”.

4. The PRA’s Approach to Policy

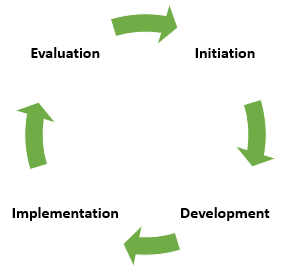

The PRA also sought to describe in the DP its approach to policymaking, much of which will continue in its present form following introduction of the Bill.

However, new aspects of the policymaking cycle that may influence its direction and outcomes include:

increased accountability through a requirement for the PRA to notify the Treasury Select Committee of any regulatory consultations, and reply to parliamentary committees’ responses to those consultations;

improved flexibility and speed of response to the need for regulatory change, and the ability to waive or modify rules on a case-by-case basis; and,

broadened engagement in the regulatory policy cycle to include academia and other stakeholders beyond the financial industry.

5. The PRA Rulebook and PRA Rules

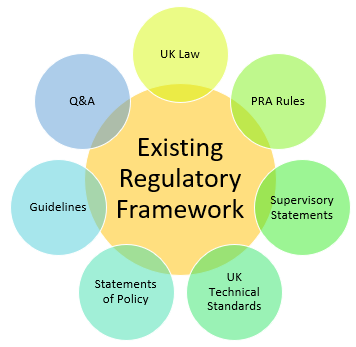

In the DP, the PRA acknowledged that the present regulatory framework is complex and widely distributed, due to the range of sources from which regulation arises.

The dispersion across multiple sources can make interpreting regulatory requirements both challenging and time-consuming. The PRA has also noted variations and inconsistencies in the use of language and certain defined terms; for example, EU law would favour terms such as “own funds” whereas the PRA prefers to refer to “capital”.

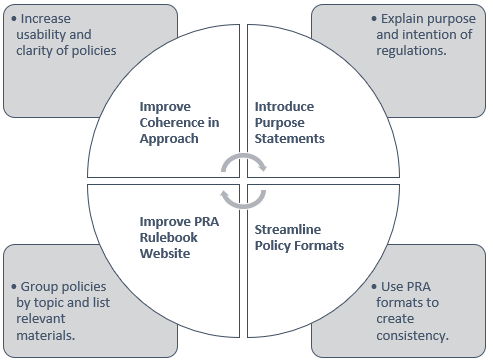

To address this, the PRA has planned a four-pronged approach to remediating the regulatory framework for the benefit of all stakeholders.

6. Timelines

With the Bill not expected to become law until 2023, the reforms proposed in the DP may not come into effect for some time. Indeed, the target to restructure and improve the PRA Rulebook website may not be completed until the end of 2023. Nonetheless, firms can expect to see notable change in the regulatory environment subject to responses to the DP and any further announcements from the PRA.