UK Pillar 3 disclosure requirements - updated framework

1. Brief background:

Basel Committee on Banking Supervision (BCBS) sets the standard for international banking prudential regulation in a series of accords (Basel Accords). The Basel Accords have been updated a number of times, most recently through a series of reforms collectively known as Basel III.

Basel accord comprises three pillars, a brief overview is given below:

2. Guiding principles for Pillar 3 disclosures as per the Bank for International Settlements (BIS)

Pillar 3 disclosures are underpinned by the following guiding principles:

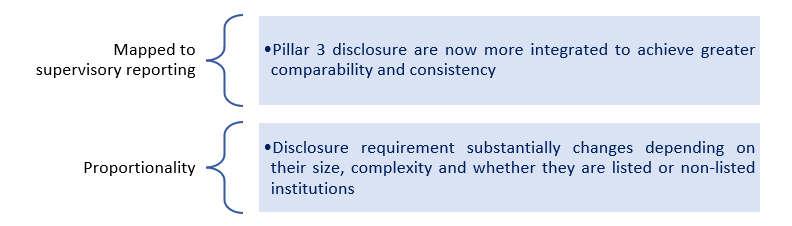

3. Key features of the revised disclosure requirements:

4. Scope:

5. Extent of the requirement for disclosure and frequency:

To determine the minimum disclosure requirements and the frequency, the first step would be to establish the classification of the firm, as the classification drives the extent and frequency of various parts of the disclosure.

Due to greater proportionality, the disclosure requirement substantially increases as we move from a ‘Small and Non-Complex Institution’ to an ‘LREQ firm’ as shown below:

Apart from the classification of the firm, another proportionality aspect is in relation to the listing status of the firm. Listed firms are subject to higher disclosure requirements.

The below table shows how the disclosure requirement changes depending on the category and listing status of the firm:

Following are the possible classifications and corresponding thresholds:

6. Key steps

Key steps to be considered while preparing and publishing the Pillar 3 disclosures as per the revised framework:

7. A summarised list of Pillar 3 disclosures requirement (effective from 1 January 2022):