UK Basel 3.1: Market Risk

On 12 December 2023, the Prudential Regulation Authority (PRA) published near-final rules on the implementation of Basel 3.1 standards through Policy Statement 17/23 (PS17/23) which offers feedback on the responses received for Consultation Paper 16/22 (CP16/22) published on 30 November 2022.

The implementation date for Basel 3.1 standards is July 1, 2025.

A summary of the changes for Market Risk, specifically under the new simplified standardised approach (SSA), is provided below.

Key changes include the following.

Clear distinction provided between the trading book and non-trading book.

Prescribed a list of positions that would need to initially be assigned to either the trading book or the non-trading book. (Also refer to the Appendix below.)

Permission from the PRA is needed where firms choose to deviate from the prescribed list.

Set restrictions on any subsequent reassignment of positions between the trading and non-trading books.

In the event of reassignment, firm needs to hold a capital add-on equal to the amount of the reduction in capital requirement due to reassignment, until the position matures.

Continue to require market risk capital requirement on FX and commodity positions, irrespective of their classification as trading book or non-trading book.

Existing Standardised Approach has been recalibrated and renamed as Simplified Standardised Approach (SSA) – this approach would be available for firms meeting either of the following criteria:

the firm’s aggregated market risk assets and liabilities are less than £440 million and less than 10% of total assets; or

the firm is eligible to use the derogation for small trading book business.

Introduced a new Internal Model Approach (IMA), replacing the current modelled approach – this approach is available for firms with supervisory approval.

Introduced a new more comprehensive standardised approach, the Advanced Standardised Approach (ASA) – this approach is available to all firms.

Existing ‘derogation for small trading book business’ would continue – as per this derogation, firms can use the credit risk approach to measure market risk for trading book positions where the size of the firm’s on- and off-balance sheet trading book business is less than:

5% of total assets, and,

£44 million.

Firms are allowed to use a combination of ASA and IMA. However, if a firm uses the SSA it would have to use it for all market risk positions.

CP17/23 – Capitalisation of foreign exchange positions for market risk - published on 27 September 2023

The PRA has published Consultation Paper 17/23 (CP17/23), which sets out its proposed clarifications and amendments when capitalising foreign exchange exposures under the market risk capital framework. The CP also sets out the process for seeking permission to exclude Structural Foreign Exchange (SFX) positions from this capital calculation.

The key proposals in CP17/23 are as follows:

Items held on the balance sheet at historical exchange rates: These positions will not be included as a risk position for the purposes of calculating Pillar 1 capital requirements, but should be considered in the Pillar 2 assessment, as these reflect contingent FX risk which can materialise in limited circumstances.

Positions eligible for the SFX permission: The CP provides more clarity on the eligibility criteria for the SFX permission and the calculation of the maximum net FX risk position for these instances. It also updates the supplementary application form for the SFX permission.

A summary of the revised approaches for market risk capital requirements is given below:

Figure 1

* Interest rate risk positions (1.3), equity risk positions (3.5), foreign exchange risk positions (1.2), and commodity risk positions (1.9).

The SSA

The SSA involves a re-calibration of the pre-existing Standardised Approach. In that sense, the existing requirements provided for by the Standardised Approach are retained (save for correlation trading portfolios, which are now excluded) with the additional application of aforementioned multipliers (see Figure 1).

The PRA’s objective is to minimise additional operational burden, whilst simultaneously ensuring adequate capital requirements in light of market risks to which firms are exposed. The re-calibrations create a SSA that is predominantly more prudent when compared to the ASA, making it appropriate for firms with smaller and typically more straightforward market risk exposures.

SSA Illustration

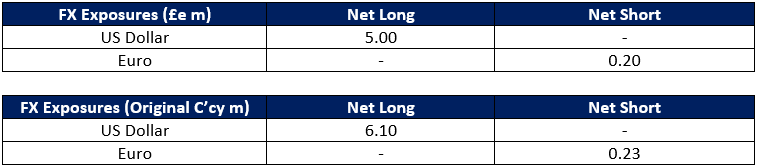

The following table provides an example of the capital requirements achieved by applying the SSA for foreign exchange risk exposures only, and for a firm whose reporting currency is Sterling: many small firms have no trading book positions and market risk only in the form of banking book foreign exchange exposures. For such firms, capital requirements for market risk will increase under the SSA.

Table 1

* Do the firm’s foreign exchange and gold positions exceed 2% of its total own funds?

The ASA

The ASA is available to all firms through optionality permitted by the PRA. However (again, considering a firm with foreign exchange risk positions only), the ASA could result in a higher capital requirement when compared to the SSA depending on a number of factors including the currencies of exposure, the number of positions, and whether positions include both long and short positions, or only long or short positions.

Furthermore, the ASA necessitates increased complexity in the calculation process meaning many small firms will not consider it worthwhile to adopt.

ASA Illustration

The following table provides an example of the capital requirements achieved by applying the ASA for the same firm with the same foreign exchange risk positions as shown in Table 1.

Table 2

Step 1) Calculate the risk factors, which are the spot exchange rates between: the currencies either referenced by an instrument or in which an instrument is denominated; and the institution's reporting currency (or if applicable its base currency*) - see Article 325q.

USDGBP = 0.8197

EURGBP = 0.8600

* A firm may, with the prior permission of the PRA, replace its reporting currency with another currency (the ‘base currency’) subject to certain conditions (such as, the base currency provides an appropriate risk representation for the firm’s foreign exchange risk positions) - see Article 325q(7).

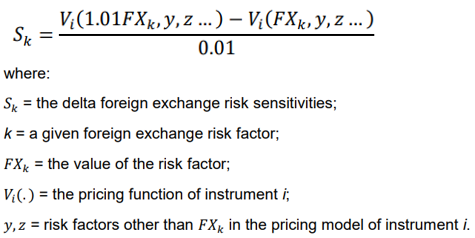

Step 2) Calculate the delta foreign exchange risk sensitivities using the following formula - see Article 325r:

Figure 2

USDGBP Sk = £5.0m [(6.1 x 1.01 x 0.8197) – (6.1 x 0.8197))/0.01]

EURGBP Sk = £(0.2)m [(-0.233 x 1.01 x 0.86) – (-0.233 x 0.86))/0.01]

Step 3) Assign risk weights for foreign exchange risk (RWk) - see Article 325av:

15% for all sensitivities, except for the most liquid currency pairs whereby the risk weight shall be = 15% / √2 = 10.6066%.

USDGBP = 10.6066%

EURGBP = 10.6066%

Step 4) Calculate the risk-weighted exposure values (WSk = Sk x RWk) - see Article 325f:

USDGBP = £0.53m [£5m x 10.6066%]

EURGBP = £(0.02)m [£(0.2)m x 10.6066%]

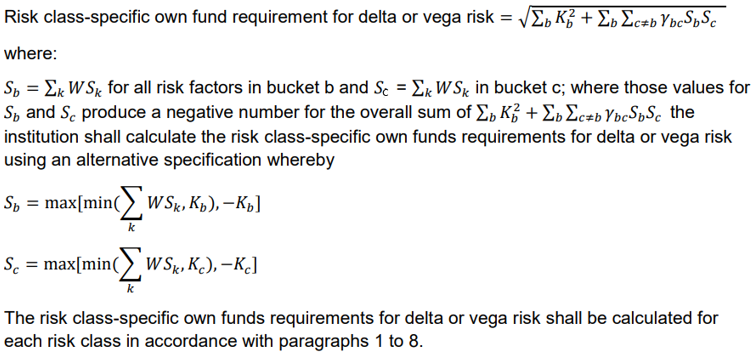

Step 5) Calculate the own funds requirements for foreign exchange risk or each correlation scenario (high, medium, low using the correlation factor ϒ). NB, there is no intra-bucket correlation for foreign exchange risk, thus Kb is equal to the risk-weighted exposure amount. See Article 325f:

Figure 3

For foreign exchange risk, the correlation factor ϒ is set to 60% [see - Article 325aw]. For each correlation scenario, apply the following ϒ [see - Article 325h]:

Medium = 60%

High: Minimum of 1.25 x 60%, and 100% = 75%

Low: Maximum of 2 x 60% - 100%, and 75% x 60% = 45%

Calculate the own funds requirements:

High = £0.518m [√((0.53^2+0.02^2)+(75% x 0.53 x -0.02)+(75% x -0.02 x 0.53))]

Medium = £0.521m [√((0.53^2+0.02^2)+(60% x 0.53 x -0.02)+(60% x -0.02 x 0.53))]

Low = £0.515m [√((0.53^2+0.02^2)+(45% x 0.53 x -0.02)+(45% x -0.02 x 0.53))]

The own funds requirement is the maximum requirement across the three scenarios [see - Article 325h], thus here the requirement is £0.52m. In this instance, the capital requirement under the ASA is higher than that required under the SSA (£0.52m versus £0.48m).

Appendix

A list of positions and their classifications is shown in the table below.

An instrument must be assigned to the trading book where it meets all of the following requirements.