UK Basel 3.1: Reporting changes

On 30 November 2022, the Prudential Regulation Authority (PRA) published a Consultation Paper 16/22 (CP16/22) proposing the implementation of Basel 3.1 standards. The framework was originally proposed to be implemented on January 1, 2025. However, according to the news release dated September 27, 2023, the revised implementation date is July 1, 2025.

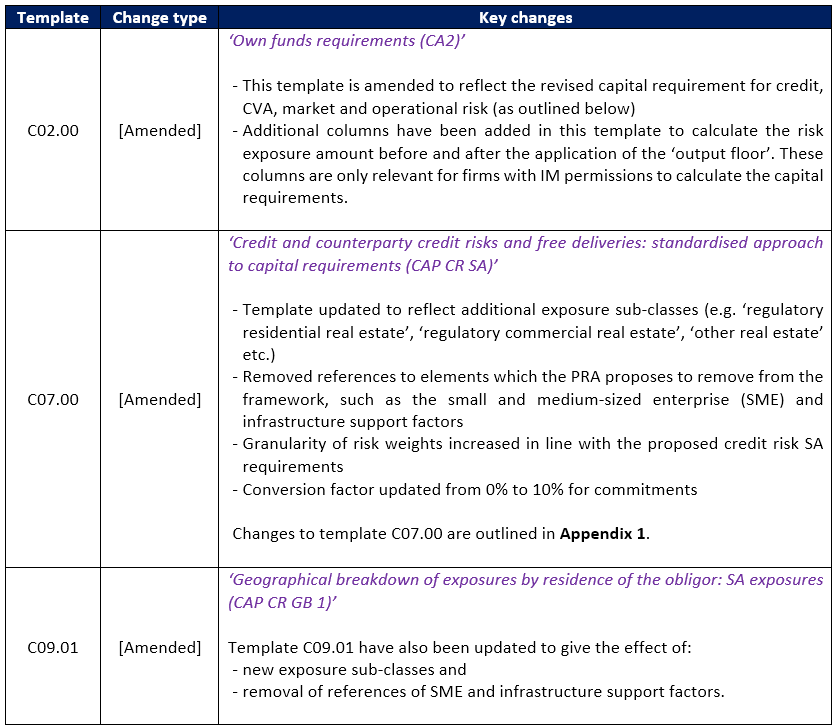

This section outlines the proposed changes to the reporting requirements. For each template, the ‘change type’ is highlighted as ‘New’ (where a new template is introduced), ‘Amended’ (where the current template is modified), and ‘Deleted’ (where the current template is proposed to be discontinued).

Reporting changes are listed below based on the risk category:

1. Credit Risk

Key reporting changes for the Credit Risk - Standardised Approach are outlined below:

2. Operational Risk

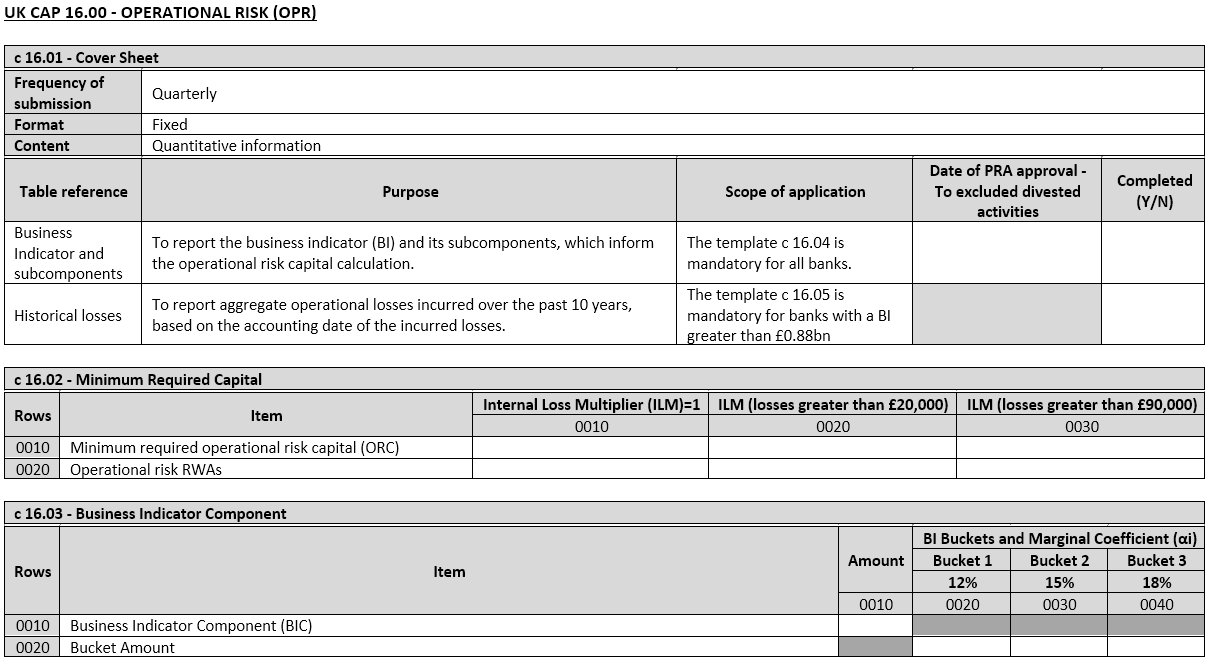

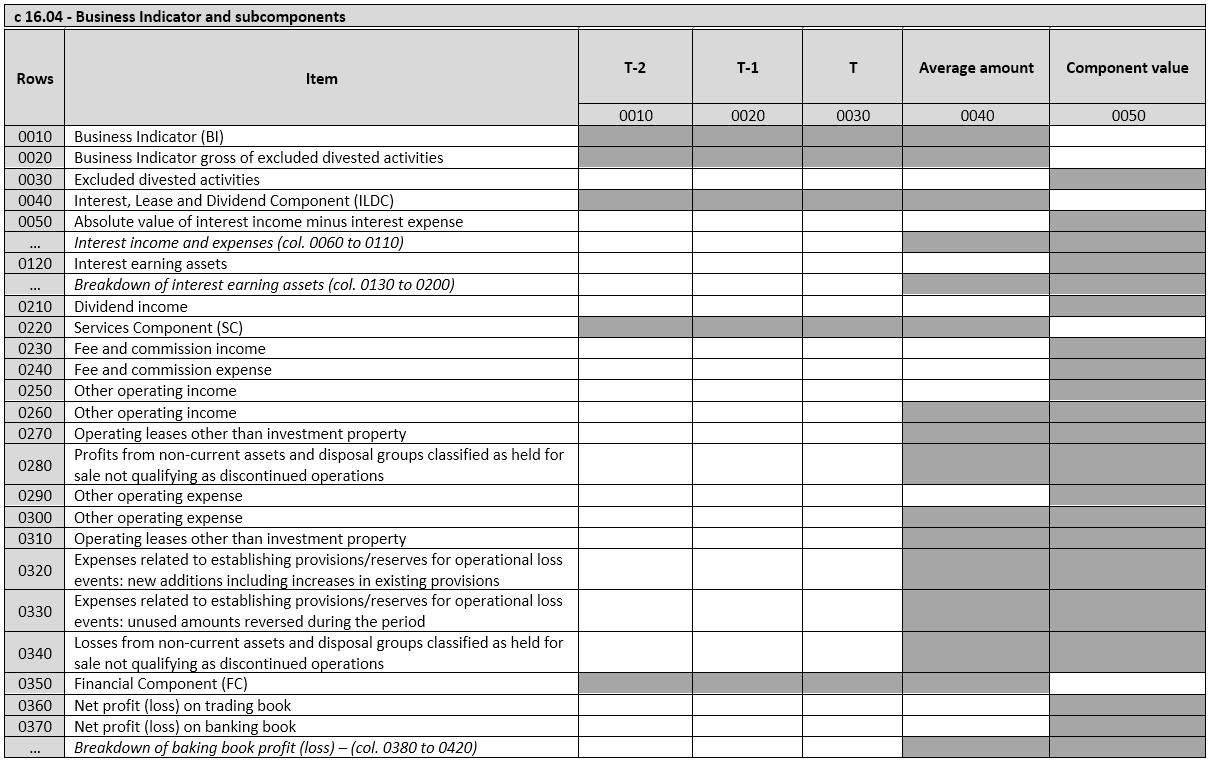

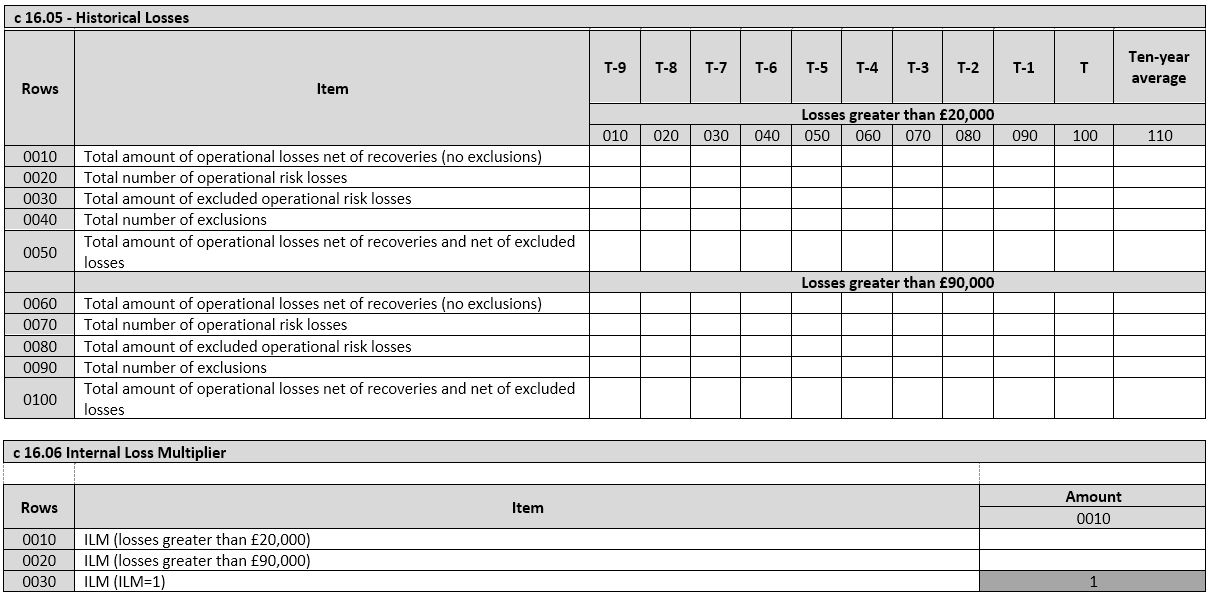

All existing operational risk approaches [Basic Indicator Approach (BIA), Standardised Approach (SA), and Advanced Measurement Approach (AMA)] are proposed to be replaced by the new Standardised Approach (SA). As a result of this, current templates are also proposed to be replaced by a new template. A brief summary of reporting requirements of the new template is outlined below:

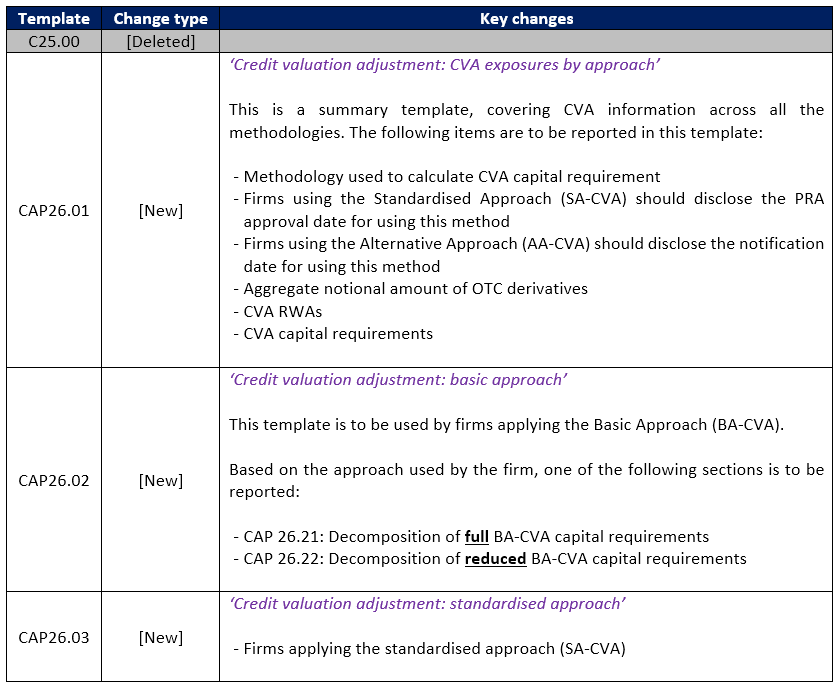

3. Credit Valuation Adjustment (CVA) Risk

The following three new methodologies have been introduced to replace the current framework:

Alternative Approach (AA-CVA)

Basic Approach (BA-CVA)

Standardised Approach (SA-CVA)

As a result of this, the current template is replaced by three new templates. A brief summary of reporting requirements of new templates is outlined below:

4. Market Risk

The following proposed changes in the calculation of the own funds requirements for Market Risk are triggering changes to the reporting requirements as well:

The existing Standardised Approach has been recalibrated and renamed as Simplified Standardised Approach (SSA)

Introduced a new more comprehensive standardised approach - the Advanced Standardised Approach (ASA)

Introduced a new Internal Model Approach (IMA), replacing the current modelled approach

A brief summary of the changes to the reporting requirements is outlined below:

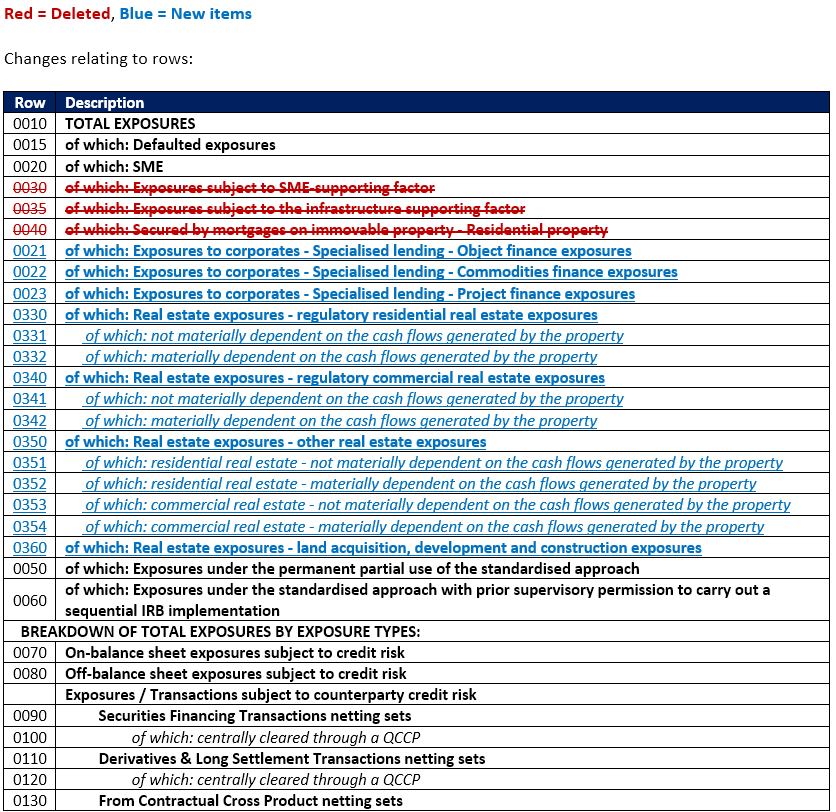

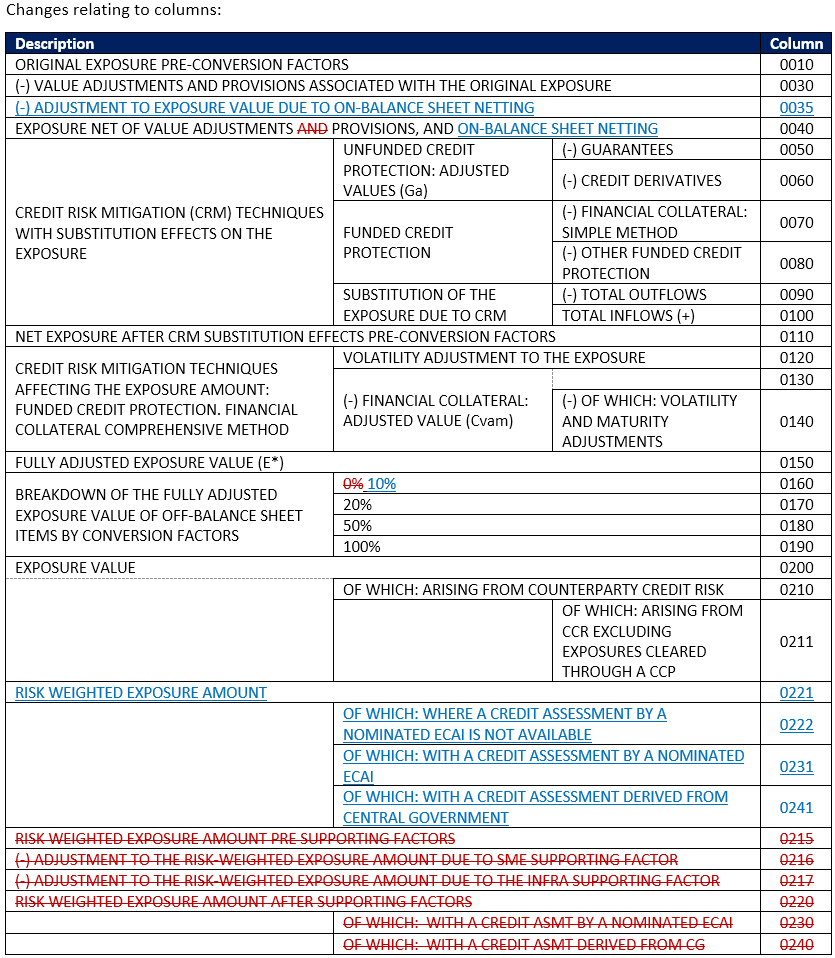

Appendix 1: Changes to the C07.00 template

Appendix 2: Proposed reporting requirements for Operational Risk