CP5/22 - Simpler-regime Firm (SRF)

The Prudential Regulation Authority’s (PRA’s) consultation paper CP5/22 proposes an introduction of a simpler regime and simplified prudential requirements for non-systemic banks and building society. This is a significant change, especially in light of the Basel 3.1 reforms (commonly referred to as Basel IV) that the PRA plans to start consultation in Q4 of this year.

In CP5/22, the PRA have proposed a definition for ‘Simpler-regime Firm’ (SRF). Banks meeting “all” the below conditions, as assessed at the highest level of the UK consolidation group^, are to be considered as SRF:-

1) Size: total assets of up to £15 billion; [FINREP Template F01.01]

2)Trading book: the bank’s on- and off-balance sheet trading book business should not exceed the following thresholds^^ [Article 94 – Derogation of small trading book business]:

a. 5% of the bank’s total assets; and

b. £44 million

3) Foreign exchange position: sum of the bank’s net foreign exchange position must not exceed 2% of the bank’s own funds [Article 351 - De minimis and weighting for foreign exchange risk]

4) Commodity position: no commodity position

5) Capital requirement approach: no internal risk based (IRB) approach approval

6) Business activity: does not provide clearing, settlement, custody or correspondent banking services to another banks or building societies^^^ either as a direct or indirect participant

7) Payment systems: does not operate payment systems

8) Geographical footprint: at least 85% of the bank’s credit exposures should be to UK obligors [COREP C09.04]

^ UK Subsidiary of overseas headquartered banking groups would be able to apply for a waiver/modification to qualify as a SRF

^^ excluding foreign exchange and commodities position

^^^ not only in the UK but located anywhere

As of December 2021, of the 198 banks and building societies, the PRA estimates that 27 banks and 34 building societies will qualify as SRF.

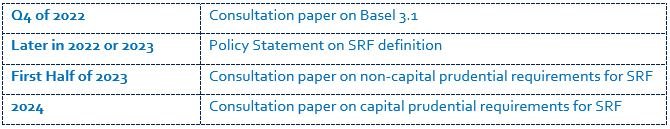

The PRA proposes to publish the Policy Statement on the definition of SRF later in 2022 or 2023. The PRA also proposes to publish the simplified prudential requirements in two phases:-

Phase 1: focused on prudential regulation that are not related to capital requirements (e.g., liquidity) in first half of 2023

Phase 2: focused on capital requirements in 2024

Proposed Key timelines: