Simpler-regime Firm (SRF) CP16/22 updates

In April 2022, the Prudential Regulation Authority’s (PRA’s) [CP5/22] proposed the introduction of a simpler regime and simplified prudential requirements for non-systemic banks and building society, and outlined the thresholds and conditions to qualify as a Simpler-regime Firm (SRF).

In CP16/22, which was published on 30th Nov 2022, the PRA has made a few changes to these thresholds. Based on the revised thresholds, banks meeting “all” the below conditions, as assessed at the highest level of the UK consolidation group^, are to be considered as SRF.

The updates to the proposed SRF definition in CP16/22 are shown in green.

1) Size: total assets of up to £15 billion £20 billion; [FINREP Template F01.01]

2) Limited trading activity: the bank’s on- and off-balance sheet trading book business should not exceed the following thresholds^^ [Article 94 – Derogation of small trading book business];

a. 5% of the bank’s total assets; and

b. £44 million (criterion will be treated as complied unless one or both thresholds are exceeded for more than three months in succession, or more than 6 months in the past year)

3) Limited foreign exchange position: sum of the bank’s net foreign exchange position must not exceed 2% of the bank’s own funds [Article 351 - De minimis and weighting for foreign exchange risk]; for more than 3 months in succession or more than 6 months in the past year (but must not breach 3.5% of the bank’s own funds at all times)

4) No Commodity position: no commodity position

5) No IRB - capital requirement approach: no internal risk based (IRB) approach approval

6) Limited business activity: does not provide clearing, settlement, custody or correspondent banking services to another banks or building societies^^^ either as a direct or indirect participant; with the exception if these services are only provided to other group entities and are in GBP

7) Not operating payment systems: does not operate payment systems

8) Limited non-UK credit exposures (geographical footprint): at least 85% of the bank’s credit exposures should be to UK obligors [the three year average] [COREP C09.04]; allowing for smoothing/flexibility (but credit exposure to UK obligors should at least be 75% at all times)

^ UK Subsidiary of overseas headquartered banking groups would be able to apply for a waiver/modification to qualify as a SRF

^^ excluding foreign exchange and commodities position

^^^ not only in the UK but located anywhere

As of December 2021, of the 198 banks and building societies, the PRA estimates that 27 banks and 34 building societies will qualify as SRF.

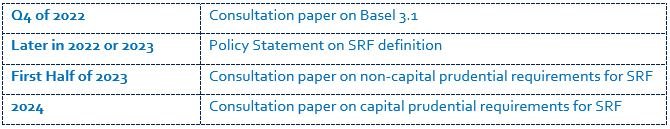

The PRA proposes to publish the Policy Statement on the definition of SRF in 2023. The PRA also proposes to publish the simplified prudential requirements in two phases:-

Phase 1: focused on prudential regulation that are not related to capital requirements (e.g., liquidity) in first half of 2023

Phase 2: focused on capital requirements in 2024

Proposed Key timelines:

Transitional Arrangements

Following transitional arrangements are proposed for a Simpler-regime firm:

Qualifying Simpler-regime firms do not need to apply the Basel 3.1 standards before the implementation of a capital framework for the simpler regime, and they can continue to follow the existing provisions until that time (Transitional Capital Regime). [para 2.17 of CP16/22]

Firms meeting the Simpler-regime criteria on 1 January 2024 can choose between being subject to the Basel 3.1 standards effective from 1 July 2025 or being subject to the Transitional Capital Regime (i.e. apply existing provisions) until the implementation date of a capital framework for the simpler regime. [para 2.18 of CP16/22]